Finance ministry releases instalment of Rs 6,000 crore to states to meet GST compensation shortfall

NEW DELHI: The Ministry of Finance, Department of Expenditure has released the 13th weekly instalment of Rs. 6,000 crore to the States today to meet the GST compensation shortfall. Out of this, an amount of Rs. 5,516.60 crore has been released to 23 States and an amount of Rs. 483.40 crore has been released to […]

GST officials recover Rs 700 crore in 2 months, arrest 215 over fake invoices

NEW DELHI: The Directorate General of GST Intelligence (DGGI) and the CGST Commissionerates have recovered more than Rs 700 crore and arrested 215 persons in the last two months in cases related to fake GST invoices that were used to illegally avail or pass on input tax credit (ITC). GST intelligence authorities have registered about […]

Telangana gets approval for additional borrowings of Rs 2,508 crore

NEW DELHI: After Andhra Pradesh and Madhya Pradesh, Telengana has become the third state to complete urban local bodies reforms stipulated by the Union finance ministry. With the completion of the reforms, the ministry has allowed the state to make additional borrowing of Rs 2,508 crore. The permission for mobilising additional financial resources of Rs […]

GST compensation shortfall: Modi government releases 10th instalment of Rs 6,000 crore to states

NEW DELHI: The Ministry of Finance has released the 10th weekly instalment of Rs.6,000 crore to the States to meet the GST compensation shortfall. Out of this, an amount of Rs.5,516.60 crore has been released to 23 States and an amount of Rs.483.40 crore has been released to the 3 Union Territories (UT) with Legislative […]

GST arm unearths Rs 832 crore tax evasion by illegal ‘pan masala’ factory

NEW DELHI: The Central GST Delhi West Commissionerate has unearthed evasion of taxes worth around Rs 831.72 crore by way of manufacture and illegal supply of ‘pan masala’ without any registration and payment of duty. The GST officials also arrested one person in the matter. An official statement said that on the basis of the […]

GST collections at all-time high of over Rs 1.15 lakh crore in December

NEW DELHI: GST collections touched a record high of over Rs 1.15 lakh crore in December, reflecting festive demand and reflating economy. The gross GST revenue collected in the month of December 2020 is Rs 1,15,174 crore and is the highest since the introduction of Goods and Services Tax from July 1, 2017, the Finance […]

Payment of 1% GST in cash only for 45,000 taxpayers: DoR sources

NEW DELHI:The mandatory requirement of 1 per cent cash payment of GST liability with effect from January 1 would be applicable to about 45,000 taxpayers, which is only 0.37 per cent of the total businesses registered in the Goods and Services Tax system, Revenue Department sources said on Saturday. To curb tax evasion by way […]

Additional borrowing permission of Rs 16,728 crore granted to 5 states

NEW DELHI: Narendra Modi government (Centre) has granted permission for additional mobilise additional financial resources to the tune of Rs 16,728 crore through open market borrowings to five states. The permission has been granted as the state have so far completed the stipulated reforms in the ease of doing business. These states are Andhra Pradesh, […]

Modi government releases Rs 42,000 crore to states to meet GST compensation shortfall

NEW DELHI: The Narendra Modi government (Centre) has so far borrowed Rs 42,000 crore since October and released the funds to states to meet GST compensation shortfall, the Finance Ministry said on Monday. The Ministry of Finance has released the 7th weekly instalment of Rs.6,000 crore to the States to meet the GST compensation shortfall. […]

‘Not against Constitution’: Supreme Court upholds GST on lottery, betting, gambling

The Supreme Court on Thursday upheld the levy of Goods and Services Tax (GST) on lotteries, betting and gambling, ruling that this doesn’t violate any constitutional provision. A bench headed by Justice Ashok Bhushan and comprising Justices R. Subhash Reddy and M.R. Shah said: “When the 2017 Act defines the goods to include actionable claims […]

All States except Jharkhand choose Option-1 to meet the GST implementation shortfall

NEW DELHI: Government of Chhattisgarh has communicated its acceptance of Option-1 to meet the revenue shortfall arising out of GST implementation. The number of States who have favoured Option-1 has gone up to 27. All States except Jharkhand and all the 3 Union Territories with Legislative Assembly have decided in favour of Option-1. The States […]

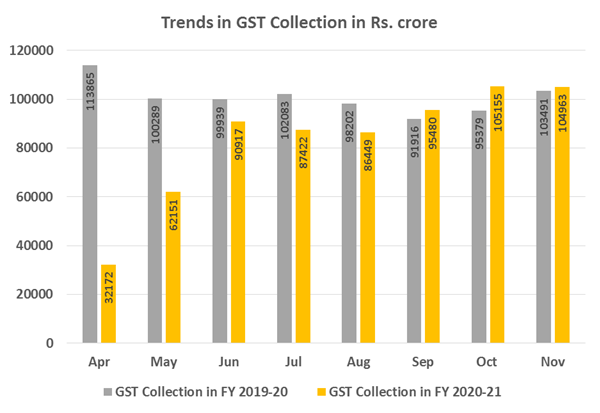

About Rs 1.04 lakh crore GST revenue collected in November

NEW DELHI: The gross GST revenue collected in the month of November, 2020 is Rs 1,04,963 crore of which CGST is Rs 19,189 crore, SGST is Rs 25,540 crore, IGST is Rs 51,992 crore (including Rs 22,078 crore collected on import of goods) and Cess is Rs 8,242 crore (including Rs 809 crore collected on […]

P&G companies fined Rs 241 crore for not passing on GST cut benefits

NEW DELHI: The National Anti-Profiteering Authority (NAA) has imposed a fine of over Rs 241.5 crore on P&G Home Products, P&G Hygiene and Healthcare and Gillette India Ltd for not passing on benefits of GST rate cut to the consumers. According to the Director General of Anti-Profiteering (DGAP), who had investigated the matter, the companies […]

GST invoices fraud: Mastermind of 115 fake firms among 59 held so far

NEW DELHI: With the arrest of Mitesh M. Shah, who created 115 fake firms to avail and pass on fraudulent input tax credit (ITC) worth Rs 50.24 crore from Gujarat’s Vadodara, the CGST Commissionerates and the Directorate General of GST Intelligence (DGGI) have so far arrested 59 persons within ten days of the nationwide drive […]

Kerala, West Bengal also choose Option 1 to meet GST implementation shortfall

NEW DELHI: The governments of Kerala and West Bengal have now accepted Option 1 to meet the revenue shortfall arising out of GST implementation. With this, the number of states who have chosen this option has gone up to 25. All the three Union Territories with Legislative Assembly (i.e. Delhi, Jammu & Kashmir and Puducherry) […]

RBI on GST: Adverse impact on manufacturing, may delay investment revival

NEW DELHI: The implementation of GST had an adverse impact on manufacturing and may delay investment revival, the Reserve Bank of India (RBI) said on Wednesday while hoping that there will a be simplification of the new indirect tax regime to ease business process. In its fourth bi-monthly monetary policy review of 2017- 18, RBI […]