More measures needed to increase liquidity: Niranjan Hiranandani

NEW DELHI: A 25 basis point rate cut by the Reserve Bank of India (RBI) would provide momentum to the market, but more needs to be done to address the issue of liquidity, stated Niranjan Hiranandani, President National Real Estate Development Council (NAREDCO) and co-founder and managing director of Hiranandani Group. The lending rate now […]

RBI alters large exposures framework for banks to cut concentration of risk

NEW DELHI: The Reserve Bank of India (RBI) on Monday modified the guidelines on large exposures for banks with a view to reduce concentration of risk and align them with the global norms. The modified ‘Large Exposures Framework’ (LEF) provides exclusion of entities connected with the sovereign from definition of group of connected counter-parties. It […]

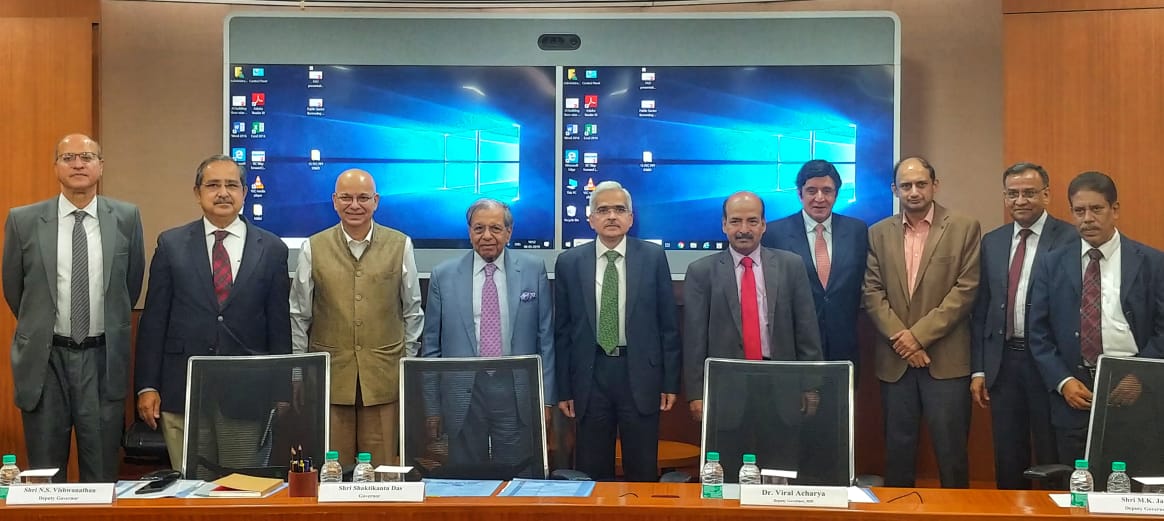

Meeting of the 15th Finance Commission with the Reserve Bank of India

NEW DELHI: The 15th Finance Commission headed by Chairman, N.K. Singh today held a detailed meeting with the Governor and Deputy Governors of RBI in Mumbai today. Key issues raised by RBI Governor, Shaktikanta Das and Finance Commission Chairman, Singh were discussed in detail at the meeting. These issues included the following:– · The necessity […]

RBI’s revised guidelines for resolution of stressed assets likely before May 23

NEW DELHI/ NEW DELHI: The Model Code of Conduct for the Lok Sabha polls is unlikely to have any bearing on issuance of a revised framework for resolution of stressed assets by the Reserve Bank and the guidelines are expected to be announced before May 23, sources said. Against the backdrop of the Supreme Court […]

RBI Governor to hold pre-policy meet with trade bodies, rating agencies on March 26

NEW DELHI: Reserve Bank of India (RBI) Governor Shaktikanta Das will hold discussions on March 26 with representatives of trade bodies and credit rating agencies on interest rate and steps to boost economic activities, said sources. The meeting, which comes ahead of the next financial year’s first MPC meet scheduled for April 4, is aimed […]

RBI imposes Rs 8 crore fine on 3 banks for non-compliance in Swift operations

NEW DELHI: The Reserve Bank of India (RBI) has imposed a total monetary fine of Rs 8 crore on three banks – Karnataka Bank, United Bank of India and Karur Vysya Bank – for non-compliance of directions on Swift messaging software. While the RBI imposed a Rs 4 crore fine on Karnataka Bank, United Bank […]

RBI to pay Rs 28,000 crore as interim dividend to government

NEW DELHI: The Reserve Bank of India (RBI) on Monday said it will give Rs 28,000 crore to the government as interim dividend. The decision was taken at the meeting of the RBI’s Central Board here. “Based on a limited audit review and after applying the extant economic capital framework, the Board decided to transfer […]

RBI to soon release new Rs 20 bank note

NEW DELHI: The Reserve Bank of India (RBI) will soon introduce a new Rs 20 currency note with additional features, according to a document of the central bank. The central bank has already issued new look currency notes in the denominations of Rs 10, Rs 50, Rs 100, and Rs 500, besides introducing Rs 200 […]

Demonetisation: Data on printing of Rs 2000, Rs 500 notes should be disclosed, says CIC

NEW DELHI: The note printing subsidiary of the Reserve Bank of India (RBI) has failed to explain how disclosure of data on Rs 2000 notes and Rs 500 notes printed after demonetisation will affect economic interests of the state, the Central Information Commission (CIC) has noted ordering its disclosure. The Bhartiya Reserve Bank Note Mudran […]

RBI’s solution for MSME loan woes: Public credit registry

NEW DELHI: The Reserve Bank of India (RBI) preferred fundamental changes to smoothen loan flow to micro-businesses through a public credit registry, rather than doling out forbearances, deputy governor Viral Acharya said on Saturday. The statement comes almost a month after the central board “advised” the monetary authority to consider a restructuring scheme for loans […]

RBI slaps Rs 1 crore fine on Indian Bank for violating cyber security norms

NEW DELHI: The Reserve Bank of India (RBI) on Tuesday said it has imposed a fine of Rs 1 crore on Indian Bank for violating cyber security norms. The RBI has imposed, by an order dated November 30, 2018, a monetary penalty of Rs 10 million on Indian Bank for contravention of Circular on Cyber […]

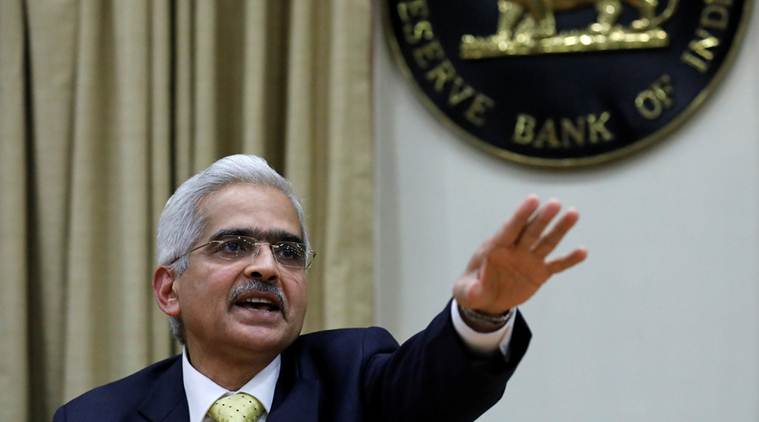

Shaktikanta Das named new RBI Governor

NEW DELHI: Former bureaucrat Shaktikanta Das on Tuesday was appointed the new governor of the Reserve Bank of India (RBI), a government statement said. He replaces Urjit Patel, who surprisingly resigned from the central bank on Monday. A former civil servant, Das is also a member of the 15th Finance Commission. Das, who retired as […]

Urjit Patel resigns as RBI Governor

NEW DELHI: Reserve Bank of India (RBI) Governor Urjit Patel, who had a run in with the government over autonomy of the central bank, Monday resigned from his post. In a brief statement, Patel said he has decided to step down with immediate effect. He, however, did not specify the reason for the decision. Patel […]

All isn’t lost for banks under PCA as their retail loan pie jumps 400 bps to 19%

NEW DELHI: The 11 state-run banks, which are under the Reserve Bank of India’s prompt corrective action (PCA) framework, has seen a 400 basis points increase in their share of retail loans at 19% of the system in the four years ending September 2018, says a report. The Reserve Bank began to place state-run banks […]

Most PCA banks meet priority sector lending goals for MSMEs, shows analysis

NEW DELHI: Amid a raging debate on need for easing rules governing credit to micro, small and medium enterprises (MSMEs), an analysis of the Reserve Bank of India’s (RBI’s) data on such loans shows a large majority of banks, including those facing ‘prompt corrective action’ (PCA), have achieved the mandatory priority sector lending targets for […]

‘New RBI window may not increase credit to NBFCs’

NEW DELHI: The partial credit enhancement (PCE)facility by the Reserve Bank of India’s (RBI) for non-bank lenders is unlikely to have the desired impact of increasing credit flow to the troubled sector, a report said on Friday. On November 2, RBI had allowed banks to provide PCE for debt raised by non-deposit-taking systematically important non-banking […]